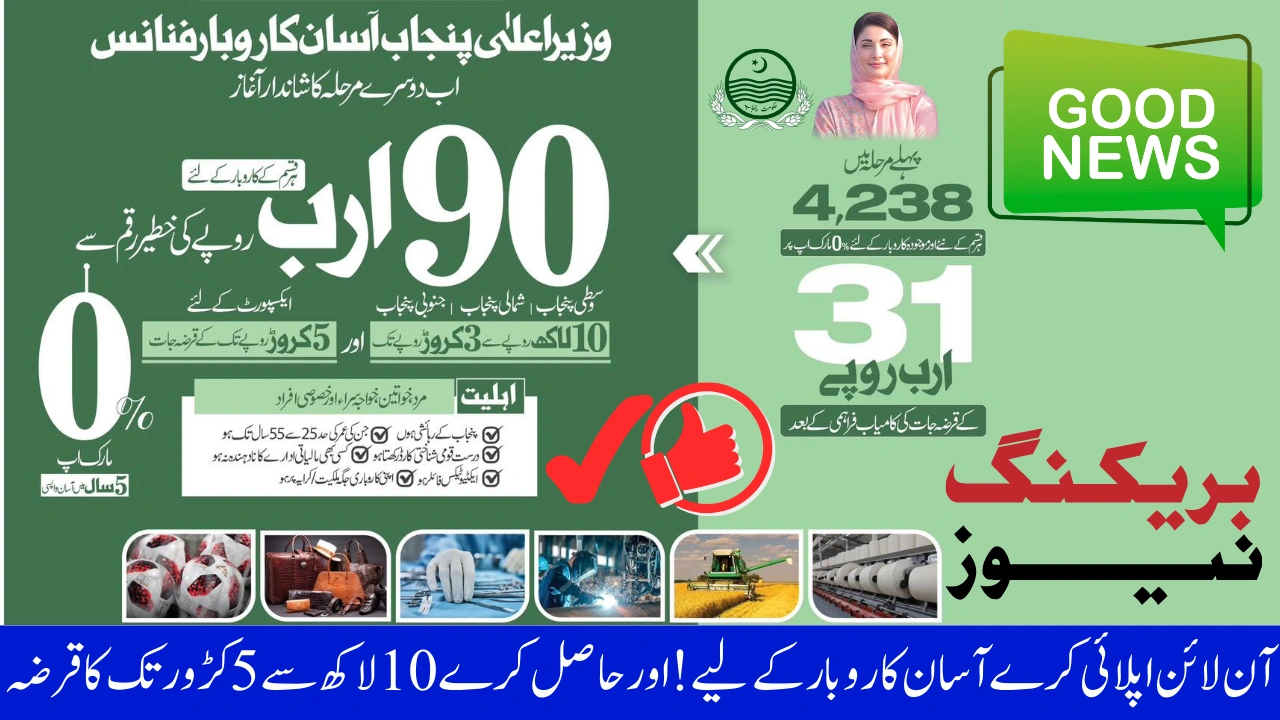

Assan Karobar Finance 2nd Phase Launched by Punjab Govt – Get Interest-Free Loan from Rs. 10 Lakh to Rs. 5 Crore

The Government of Punjab has officially launched the second phase of the Assan Karobar Finance Scheme 2025, giving a huge boost to small and medium businesses (SMEs), entrepreneurs, and youth across the province. This flagship initiative is designed to provide interest-free loans ranging from Rs. 10 lakh to Rs. 5 crore, helping people expand their businesses, start new ventures, and generate employment.

This article will cover everything you need to know about the 2nd phase, including eligibility, loan limits, how to apply, and its benefits.

What’s New in the 2nd Phase of Assan Karobar Finance Scheme?

After the success of the first phase, where thousands of applicants benefited, the Punjab government has rolled out the 2nd phase with even bigger opportunities. Unlike the earlier stage that focused on small businesses, this phase is more inclusive and designed to support:

-

Small, Medium, and Large Enterprises

-

Farmers, Traders, and Manufacturers

-

Women Entrepreneurs and Youth Start-ups

The government has expanded the scheme to cover loans up to Rs. 5 crore, allowing even mid-sized industries and businesses to take advantage. The repayment plan is flexible, with a 5-year installment structure and 0% markup. This means you return only the principal amount without paying any extra interest.

Eligibility Criteria for Phase 2

To make sure loans go to genuine entrepreneurs, the Punjab government has set simple and clear eligibility requirements:

-

Residency: Must be a permanent resident of Punjab.

-

Age Limit: Between 21 and 55 years.

-

Business Type: Open for start-ups, existing businesses, or expansion projects.

-

Special Quota: Women, youth, and differently-abled persons have reserved slots.

-

Documentation Required:

-

Valid CNIC

-

Business plan or project proposal

-

Proof of residence in Punjab

-

Basic financial details

-

The application process is designed to be hassle-free and transparent, with no hidden charges.

Loan Limits & Repayment Plan

The 2nd Phase offers interest-free financing under the following categories:

| Category | Loan Amount | Markup | Repayment Period |

|---|---|---|---|

| Small Business Loans | Rs. 10 Lakh – Rs. 50 Lakh | 0% | 5 Years |

| Medium Business Loans | Rs. 50 Lakh – Rs. 2 Crore | 0% | 5 Years |

| Large Enterprises | Rs. 2 Crore – Rs. 5 Crore | 0% | 5 Years |

This wide range ensures that every business – from shopkeepers to manufacturers – can benefit.

How to Apply for Assan Karobar Finance (Phase 2)

The Punjab government has made the application process digital to ensure ease and fairness. Here’s a step-by-step guide:

-

Visit Official Website: Go to akf.punjab.gov.pk.

-

Create an Account: Register using your CNIC and mobile number.

-

Fill Application Form: Enter personal details, business type, and required loan amount.

-

Upload Documents: Attach CNIC copy, business proposal, and proof of residence.

-

Submit Application: Get a tracking ID for future updates.

-

Verification & Approval: Once verified, your loan will be approved.

-

Disbursement: Loan will be released via Bank of Punjab (BOP) directly into your account.

This entire process is free of cost – applicants are advised to avoid agents or middlemen.

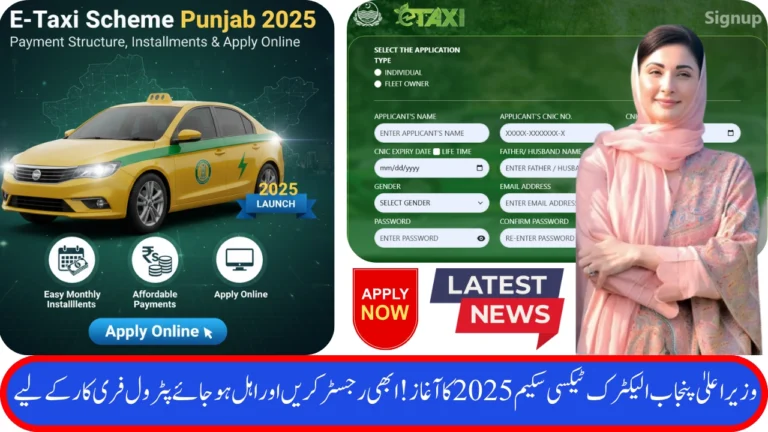

Also Read: CM Punjab Green E-Taxi Scheme 2025 – September Registration & Latest Updates

Conclusion

The launch of the 2nd Phase of Assan Karobar Finance Scheme 2025 marks a historic step by the Punjab government towards economic empowerment. With loans ranging from Rs. 10 lakh to Rs. 5 crore at 0% interest, this scheme is a golden opportunity for youth, women, and entrepreneurs to start or expand their businesses without financial stress.

If you are planning to set up a new venture or grow your existing business, now is the right time to apply and make the most of this initiative.